Cite this page

The NPV of leasing and buying were found to be negative indicating the projects will cost money rather than make money for the company. The NPV of leasing is ($82,) however, for buying the costs are not as high showing an NPV of ($59,). These values lead us to an NAL of ($23,) which indicates buying is better than leasing. 2 The decision to buy or lease business equipment is unique. It must be made on a case-by-case basis. Leasing equipment preserves capital giving the business more flexibility. While leasing can be good in the short run it can cost you more in the long run. We will look at the advantages and disadvantages of leasing Buying requires a down payment in the form of trade or cash whereas leasing requires little or no down payment. Monthly payments are based on the purchase price of the vehicle if bought, but if leased payments are based on the use of the vehicle. Although if leasing, the payment terms are incredibly shorter

Buying A Vehicle Loan Is Intimidating

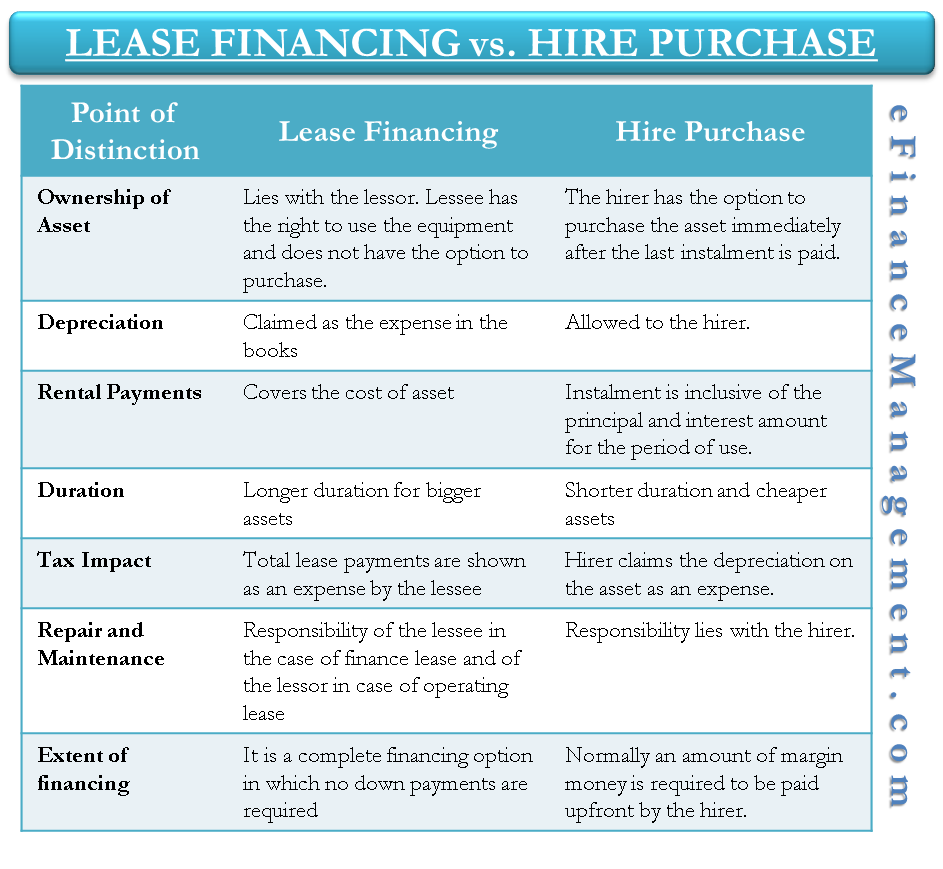

· Lease is an agreement in which one party gains a long term rental agreement, and the other party receives a form of secured long term debt. On the other hand, buying involves transfer of ownership from seller to buyer. Buying or leasing decision depends mostly on customer’s preference The decision to buy or lease business equipment is unique. It must be made on a case-by-case basis. Leasing equipment preserves capital giving the business more flexibility. While leasing can be good in the short run it can cost you more in the long run. We will look at the advantages and disadvantages of leasing Buying vs. Leasing a Vehicle: A Comparative Analysis Words14 Pages To buy or to lease a car Abstract The lease versus buy decision is usually tough for many managers since these two options are profitable for the company and bear advantages. Understanding the impact of the decision to buy or lease a vehicle is quite tough for the managers

Works Cited

In the long-term, buying a car is cheaper than leasing. In a Consumer Reports study, the purchase of a Toyota RAV4 (MSRP $20,) from a dealer saved the buyer $4, versus back-to-back leases of the same vehicle Buying vs. Leasing a Vehicle: A Comparative Analysis Words14 Pages To buy or to lease a car Abstract The lease versus buy decision is usually tough for many managers since these two options are profitable for the company and bear advantages. Understanding the impact of the decision to buy or lease a vehicle is quite tough for the managers Get a verified expert to help you with Buying vs Leasing Hire verified writer $ for a 2-page paper Some leases are merely rentals, whereas others are effectively purchases. FASB classifieds lease as an operating lease or a capital lease. A lease must meet one of the following criteria’s to be considering a capital blogger.comted Reading Time: 10 mins

Buying vs. Leasing a Vehicle: A Comparative Analysis Words14 Pages To buy or to lease a car Abstract The lease versus buy decision is usually tough for many managers since these two options are profitable for the company and bear advantages. Understanding the impact of the decision to buy or lease a vehicle is quite tough for the managers · Lease is an agreement in which one party gains a long term rental agreement, and the other party receives a form of secured long term debt. On the other hand, buying involves transfer of ownership from seller to buyer. Buying or leasing decision depends mostly on customer’s preference The NPV of leasing and buying were found to be negative indicating the projects will cost money rather than make money for the company. The NPV of leasing is ($82,) however, for buying the costs are not as high showing an NPV of ($59,). These values lead us to an NAL of ($23,) which indicates buying is better than leasing. 2

Buying requires a down payment in the form of trade or cash whereas leasing requires little or no down payment. Monthly payments are based on the purchase price of the vehicle if bought, but if leased payments are based on the use of the vehicle. Although if leasing, the payment terms are incredibly shorter · Of course, the brightest difference between car buying and leasing is its cost. Normally, if purchasing an auto, you get a high percentage rate of the loan and from 10 to 20% of down payment, in contrast, by leasing a car, you pay only monthly fees, but Estimated Reading Time: 7 mins In the long-term, buying a car is cheaper than leasing. In a Consumer Reports study, the purchase of a Toyota RAV4 (MSRP $20,) from a dealer saved the buyer $4, versus back-to-back leases of the same vehicle

No comments:

Post a Comment